If you’ve been following real estate headlines, you’ve probably noticed a familiar theme: whispers of a “housing crash” like we saw in 2008. But here’s the reality—2025 is not 2008, and the fundamentals of today’s market are dramatically different.

1. Lending Standards Are Stronger Than Ever

In the mid-2000s, loans were being handed out with little to no documentation. Today, buyers must meet far stricter lending requirements, with higher credit standards and income verification. This creates a more stable foundation for homeowners.

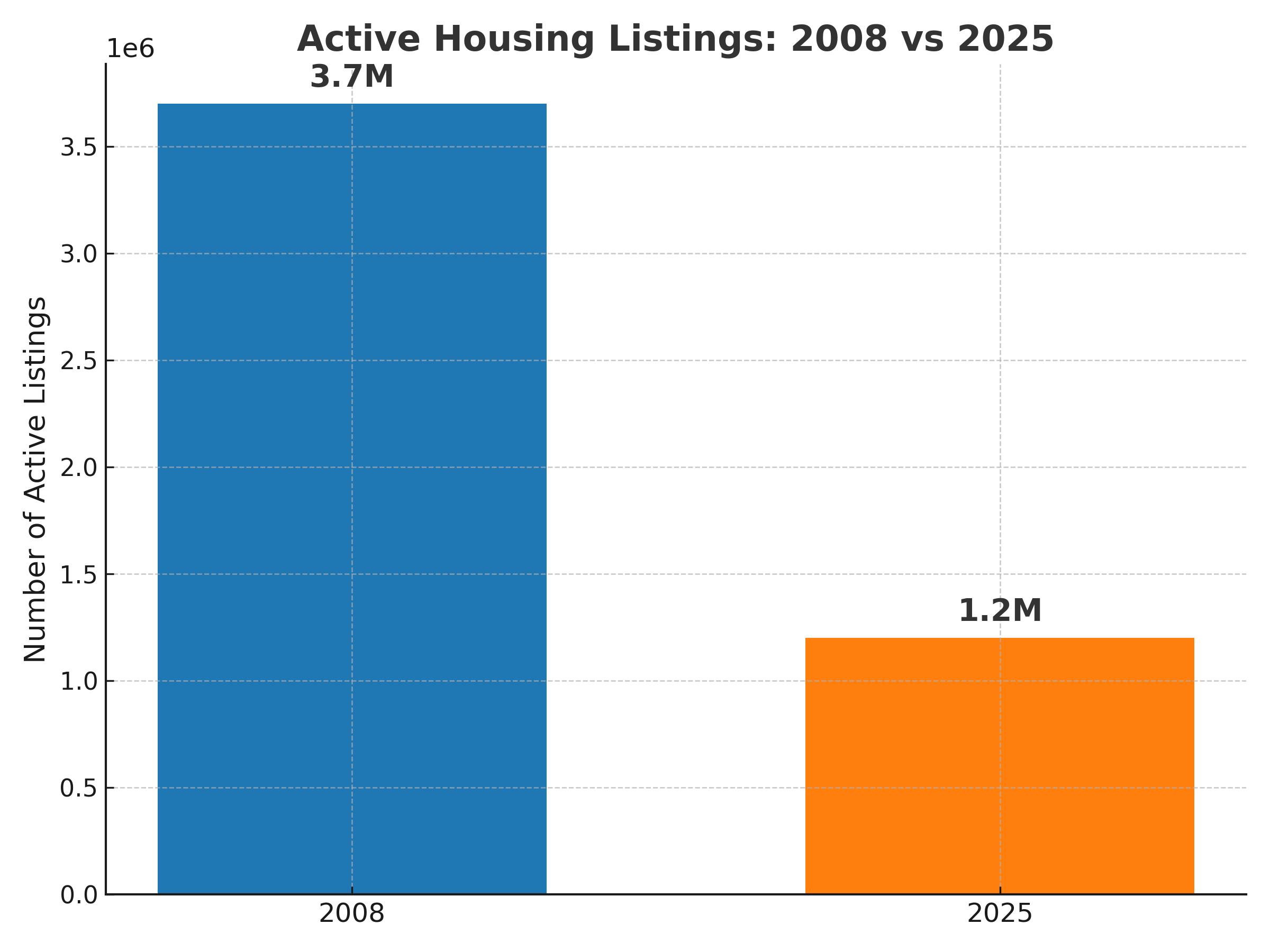

2. Inventory Is Still Limited

One of the biggest differences? Supply. In 2008, there was a flood of homes on the market. Today, inventory in Los Angeles and Ventura Counties is still well below what’s considered “normal.” That shortage continues to support home values.

3. Equity Is Protecting Homeowners

Most homeowners today have significant equity, unlike 2008 when many were over-leveraged. This means fewer people are forced into foreclosure if they face financial challenges.

4. Demand Is Still Strong

Southern California remains a highly desirable place to live. Between job opportunities, lifestyle, and limited land, demand continues to outweigh supply. Even as interest rates fluctuate, serious buyers are still in the market.

Conclusion

While no market is without its ups and downs, the 2025 housing market is fundamentally more secure than what we saw in 2008. If you’re considering buying or selling, understanding the real factors driving today’s market can give you the confidence to make your next move.

👉 If you’d like to talk specifics about your neighborhood in Los Angeles or Ventura County, reach out anytime—I’m always here to provide clarity and strategy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link